It Might be Time for Small-Caps to Start Caring About ESG

Nasdaq data shows it could significantly impact your future ability to attract and retain investors.

by Amanda Gerut

So far, sustainability and environmental, social, and governance issues (“ESG”) have resided squarely in the realm of mid- and large-cap companies and their investors. Larger companies and boards that were flat-footed in understanding and operationalizing ESG are now being forced to play catch up and are working to avoid being tagged as ESG laggards by investors and activists.

For small-cap companies, now might be the time to start understanding ESG, speaking to your largest investors about it, and discussing it in board meetings. Companies that can show investors they are ahead of the issue — reducing climate-related risks in supply chains, upholding strong governance norms, and reducing workplace inequality, for instance — will likely fare better when investors start asking questions.

What is ‘ESG?’

ESG is the all-encompassing term to describe a host of issues related to sustainability and environmental, social, and governance topics.

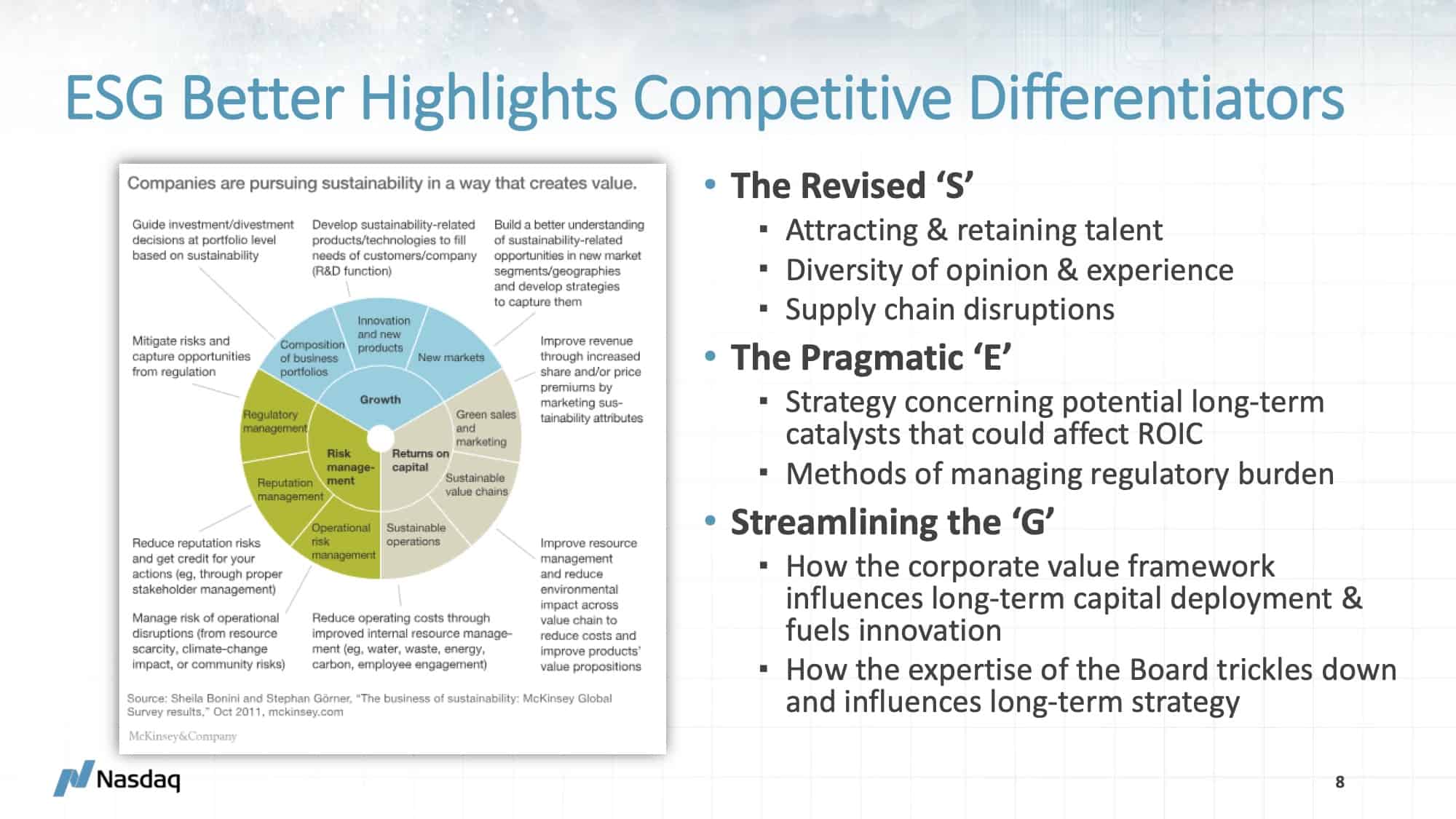

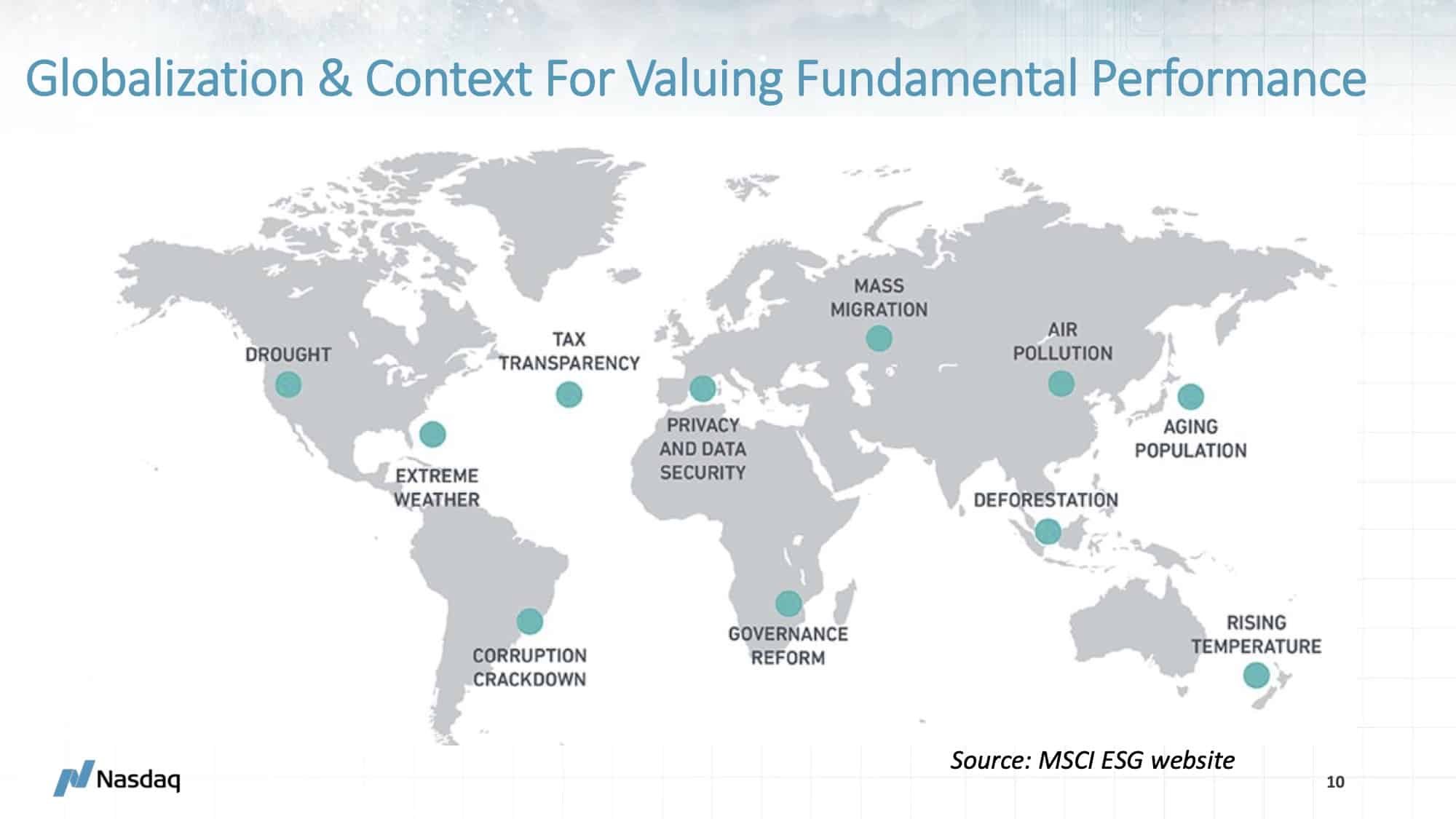

The “E” in ESG refers to “environmental” issues and is often associated with risk oversight and mitigation. Investors typically want to understand how companies are thinking and planning for operational and business-model risks related to the increasing prevalence of climate-change issues, the decline of arable land, water scarcity, and decreasing natural resources.

The “S” stands for “social,” and includes topics related to employee policies, such as pay equity, workplace safety, employee turnover, and processes related to handling misconduct and harassment. Social issues such as stakeholder and community concerns also fall under this category, as well as product liability.

“Governance” is the “G” in ESG. It refers to governance topics such as board oversight, board composition and diversity, the presence of independently led board committees, and the current corporate governance guidelines and processes underpinning the board. Investors want to see boards populated by directors with varying areas of expertise who can demonstrate strong independence and who aren’t on too many boards. Governance also includes issues related to ethics and compliance, such as codes of conduct among suppliers and other sources of potential reputation risk.

Why Should Small-Caps Care?

Right now, most investors in small-cap companies aren’t as focused on ESG as investors in mid- and large-cap companies. This is likely to change.

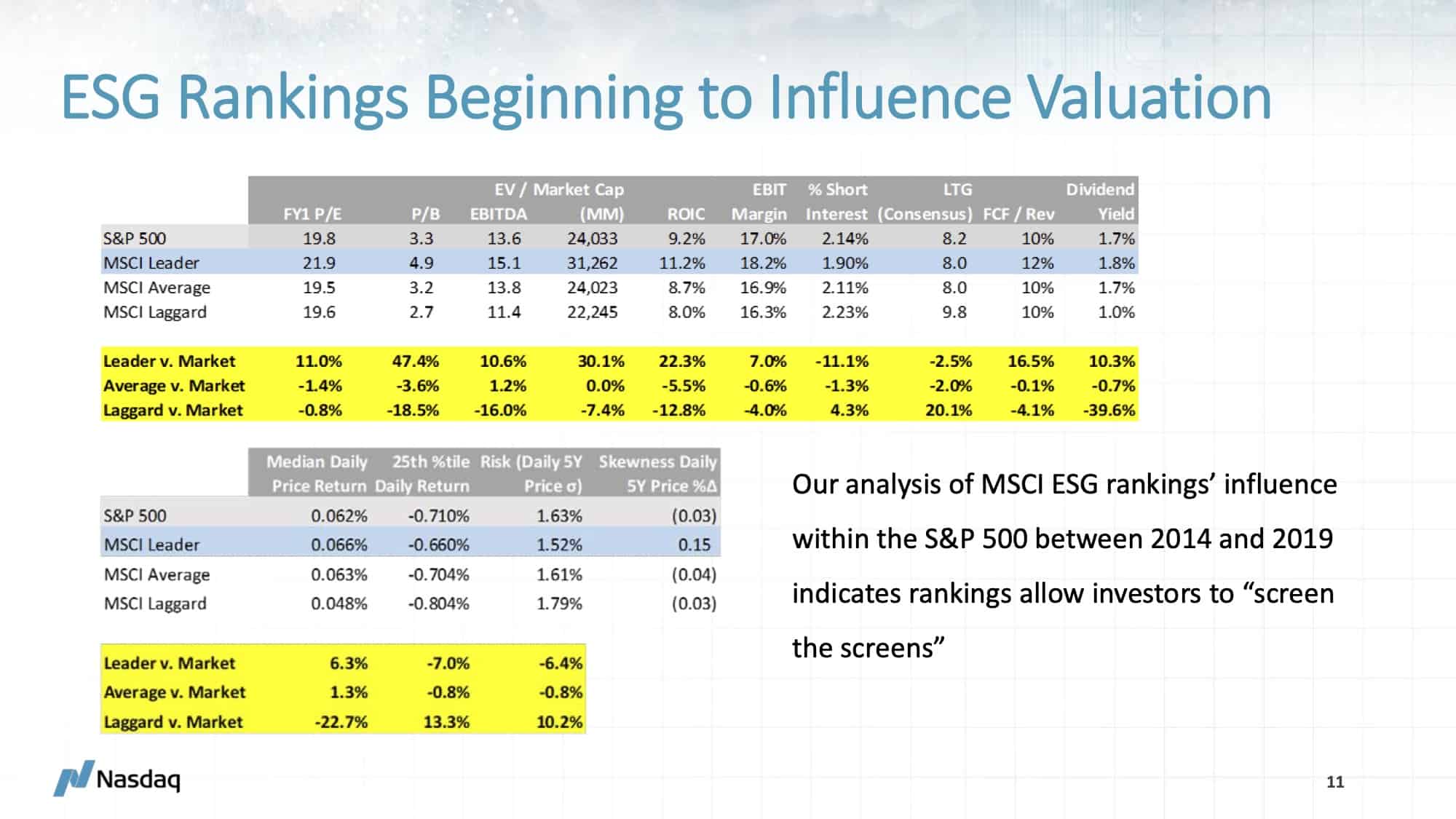

As you can see in the slide presentation which accompanies this article, a Nasdaq analysis found that the price-to-earnings ratio of companies identified as ESG “leaders” were 11 percent higher than the S&P 500 market average. In comparison, ESG “laggards” were negative .8 percent compared to the market average.

It is clear that ESG is quickly evolving from a “nice to have” to a “must have” in larger public companies. As is often the case in capital markets, what investors are scrutinizing in larger companies often makes its way to smaller companies. ESG is unlikely to be an exception.

Dollars Don’t Lie

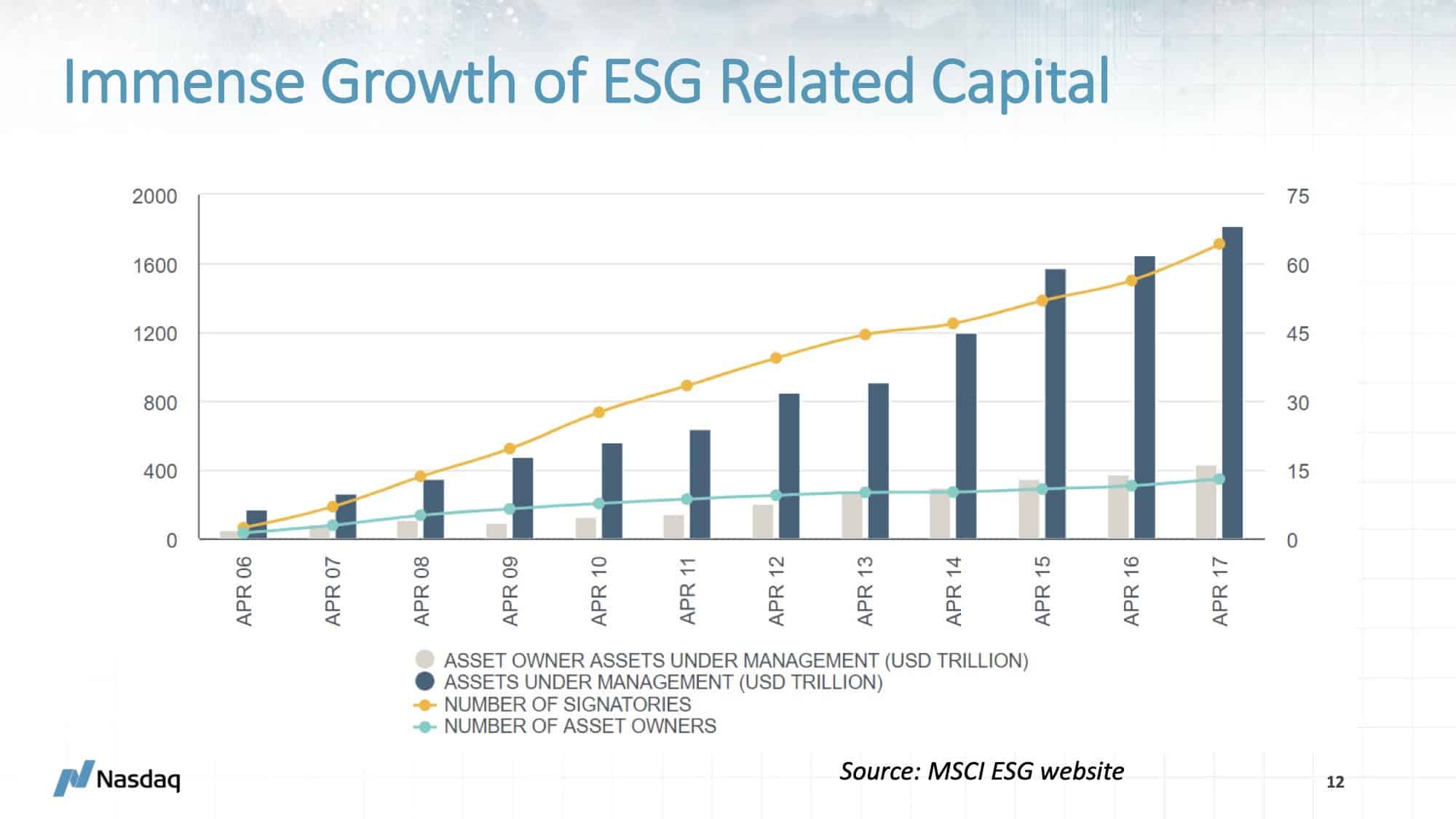

In April 2012, there were approximately $30 trillion in ESG-related funds under management. By April 2017, that figure had doubled, and continues to increase. With more than $60 trillion in ESG-related funds, this is not a passing fad.

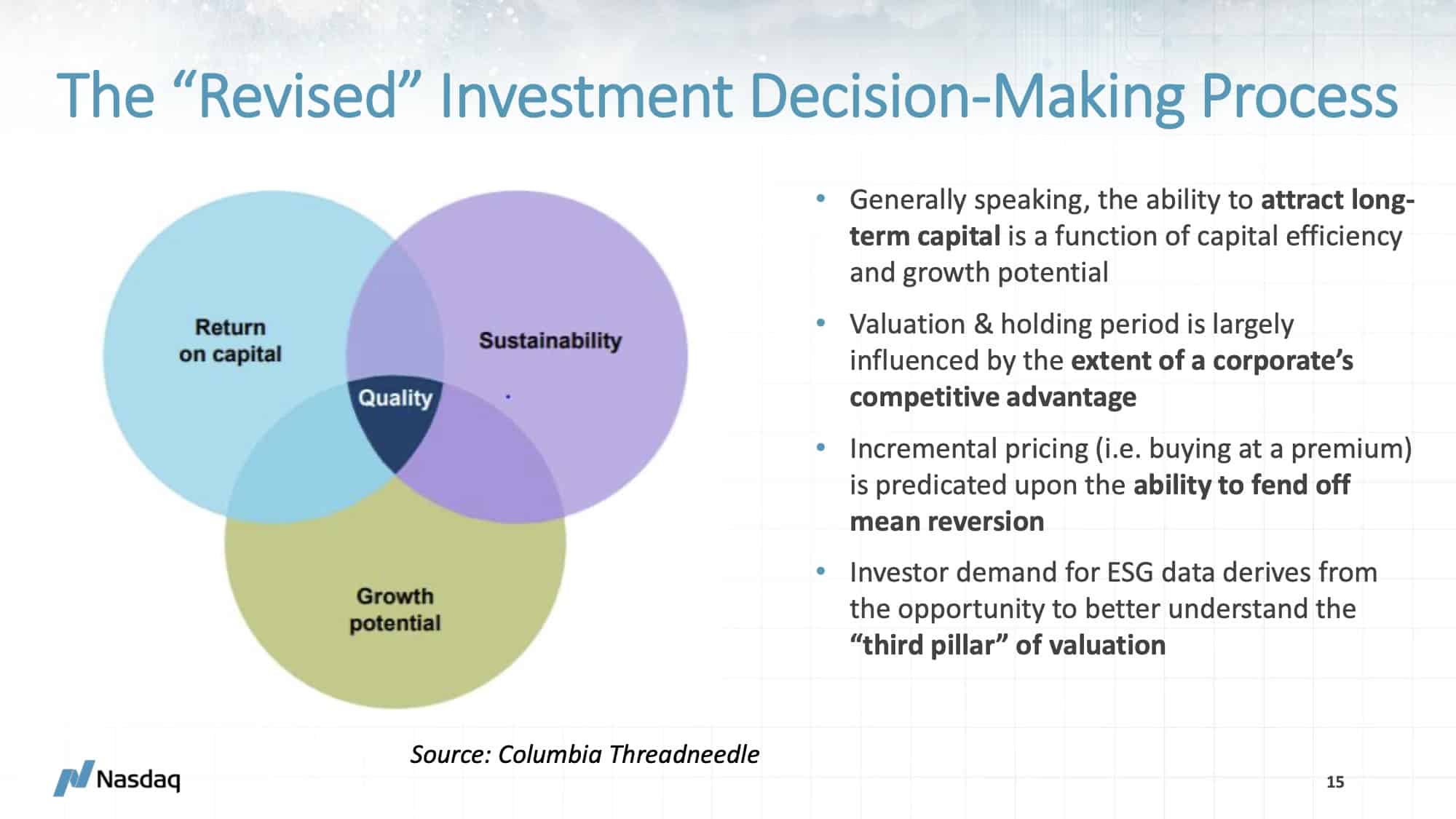

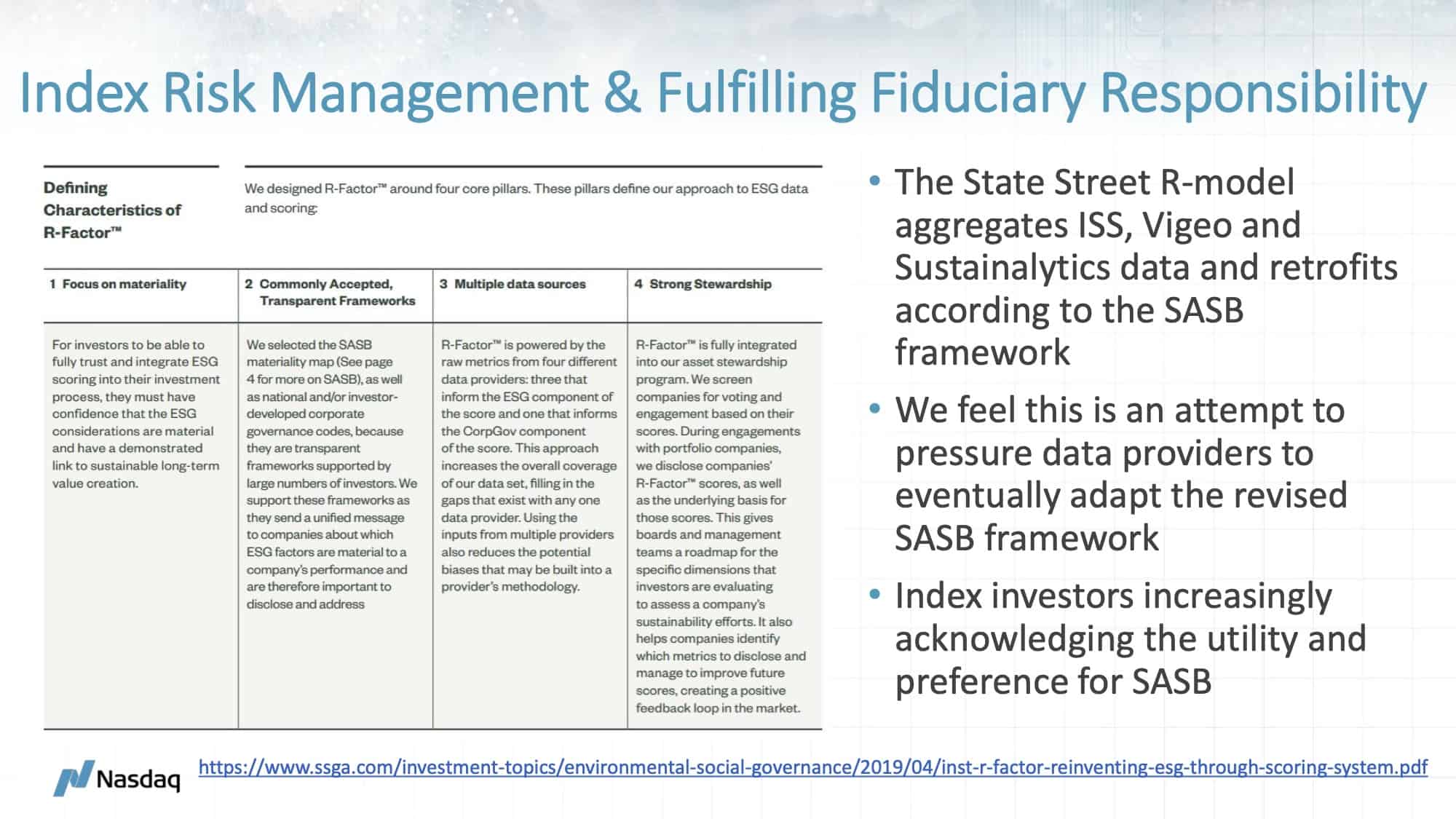

Forward-thinking larger companies are gauging how to integrate sustainability and ESG in a way that differentiates them from competitors. Boards are reviewing the way returns on capital are impacted by stronger employee engagement and reduced operating costs from more efficient management of energy sources and waste-management programs. Boards also want to know that management teams have thoroughly reviewed the potential environmental risks in the company’s supply chain and that operational disruptions have been minimized.

Moreover, companies are communicating their efforts on ESG to investors and seeing benefits in the form of stronger stakeholder management, improved revenues through increased share prices and the ability to enter new market segments and geographies.

While small public companies needn’t necessarily take the same actions today, high-performing boards should, at a minimum, task management with assessing the ESG focuses of their largest investors.

What Can Small-Cap Companies Do Now?

Here are some steps that small-cap leaders should begin considering:

- Make sure you understand if and how your current investors are thinking about ESG.

- When you meet with prospective investors, inquire about whether ESG is part of their capital allocation decision-making processes.

- For boards, taking the broad issues of sustainability and ESG and breaking it into pieces to identify which particular E, S, and G issues impact their specific company is the first step.

- From there, the board and management team should understand the potential risks related to each issue deemed material or significant and manage and monitor them. Adopting a set of metrics the board can review several times a year will allow the company to gauge over time how it is faring.

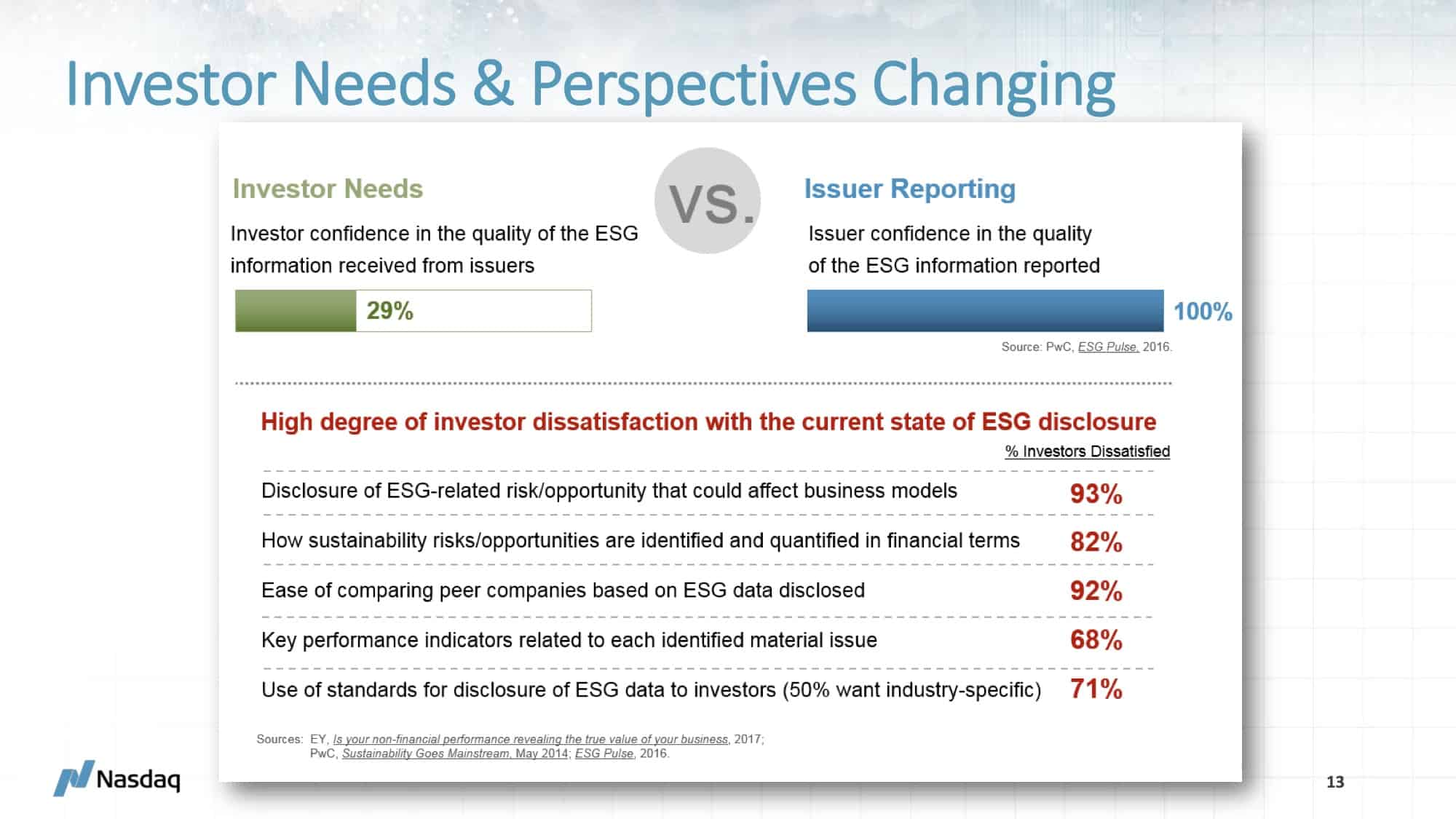

- Companies that can show investors that they’ve assessed their business risks and operations through an ESG lens and can meaningfully communicate their risks and opportunities with metrics, data, and information, will likely be more attractive to investors.

- Not all issues related to ESG will be material for all companies, but boards should ensure the management team has carefully considered those that are, and those that aren’t.

Irrespective of company size, investors are focused on ESG, because they believe it will improve long-term shareholder value. As my fellow SCI editorial advisory board member Adam J. Epstein commented in this piece for Nasdaq: “(1) focus on ESG and boardroom thought diversity is not fleeting; and (2) shareholders can likely benefit from both.”

Other constructive Nasdaq resources on this topic are:

https://www.nasdaq.com/news-and-insights/topic/leadership-corporate-governance/esg

https://www.nasdaq.com/news-and-insights/topic/leadership/sustainability